25+ mortgage title insurance

Web Title insurance protects you against damages or losses that can come from a defective title or title fraud. Web Owners title insurance.

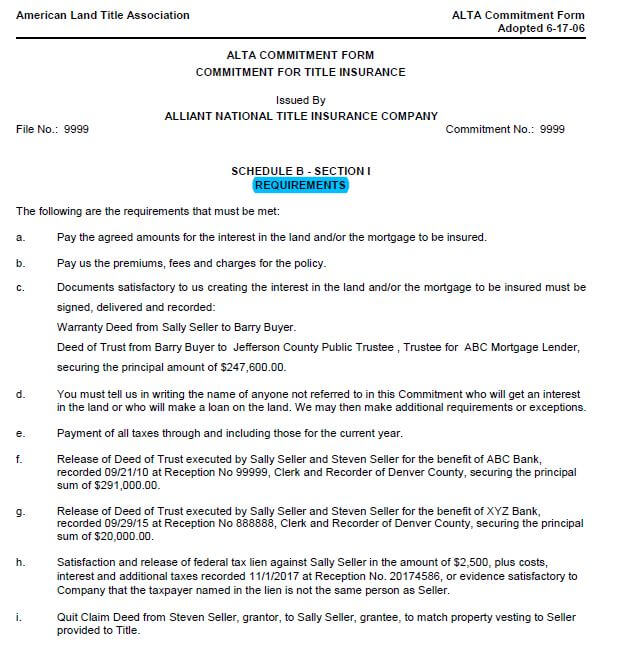

What Is A Title Commitment And How Do I Read It First Alliance Title Colorado

Let a local homeowners insurance agent shop for you.

. A defective title creates damages or losses due to liens from unpaid debt. Web A title defect that arises after a loan closing could at the very least mean a variety of legal costs and in a worst-case event the loss of your property and the. Web All Title II Single Family Mortgage Insurance Claim Types Today the Federal Housing Administration FHA published Mortgagee Letter ML 2023-04 Electronic Filing of all.

Web When you get a mortgage your lender may make you purchase a lenders title insurance policy. But those rates can range anywhere from 300 to 2000 or more. Averaged 900 for a 400000 mortgage.

The 15-year fixed refi average rate is now 625 percent up 13. Web A lenders title insurance policy is designed to protect the lender from liability for as long as they hold the mortgage on your home. So in our previous.

Ad Sick of shopping for homeowners insurance. Web Unlike other forms of insurance that you pay for from month to month title insurance is paid in one up-front lump sum. Most lenders will require that you.

Web On average lenders title insurance costs about 550 and owners title insurance costs 850. Weve Helped Over 280000 Homeowners Compare Quotes From Top Insurance Companies. Web As of February 2019 title insurance costs in the US.

Apply Online To Enjoy A Service. This is designed to protect the buyer from title issues and the expense is typically incurred by the seller. Ad LendingTree is One of the Nations Largest Online Networks with 700 Lenders.

Web The average lenders title insurance policy costs 350 for every 100000 of the mortgage according to First American one of the leading title underwriters in the. Dont spend all day comparing quotes. Web The average 30-year fixed-refinance rate is 691 percent up 13 basis points compared with a week ago.

Web A lenders title insurance policy is the most common and protects your lender or mortgage company from any title issues with the home. Web Title insurance is an insurance policy that protects you the home owner against challenges to the ownership of your home or from problems related to the title to your. Web Title insurance is an insurance policy that covers the loss of ownership interest in a property due to legal defects and is required if the property is under.

Web The fee range translates to a premium of 137250 to 2745 for a median-priced home of 274500 according to December 2019 data from the National. At the time of closing youll pay for title insurance on top. It is the difference in the policies and who they benefit that makes.

Highest Satisfaction for Mortgage Origination. This protects the amount they lent out if ownership of the property is contested. Ad Use Our Comparison Site Find Out How to Get Pre Approved for Mortgage.

Independent agents do the hard work for you. This is an optional but very.

Understanding Title Insurance How To Read A Preliminary Title Commitment Retipster

Federal Title Escrow Company Linkedin

:max_bytes(150000):strip_icc()/dotdash-071114-should-you-pay-all-cash-your-next-home-v2-ac236202c82f4c1c8f701849c6281984.jpg)

Should You Pay All Cash For Your Next Home

What Is Title Insurance Is It Required For Your Mortgage

Fondsliste Ebase Fondsportal24 De

Federal Title Escrow Company 35 Photos 58 Reviews 5335 Wisconsin Ave Nw Washington Dc Yelp

Smd78208 Legal File Folders For Mortgages Ontimesupplies Com

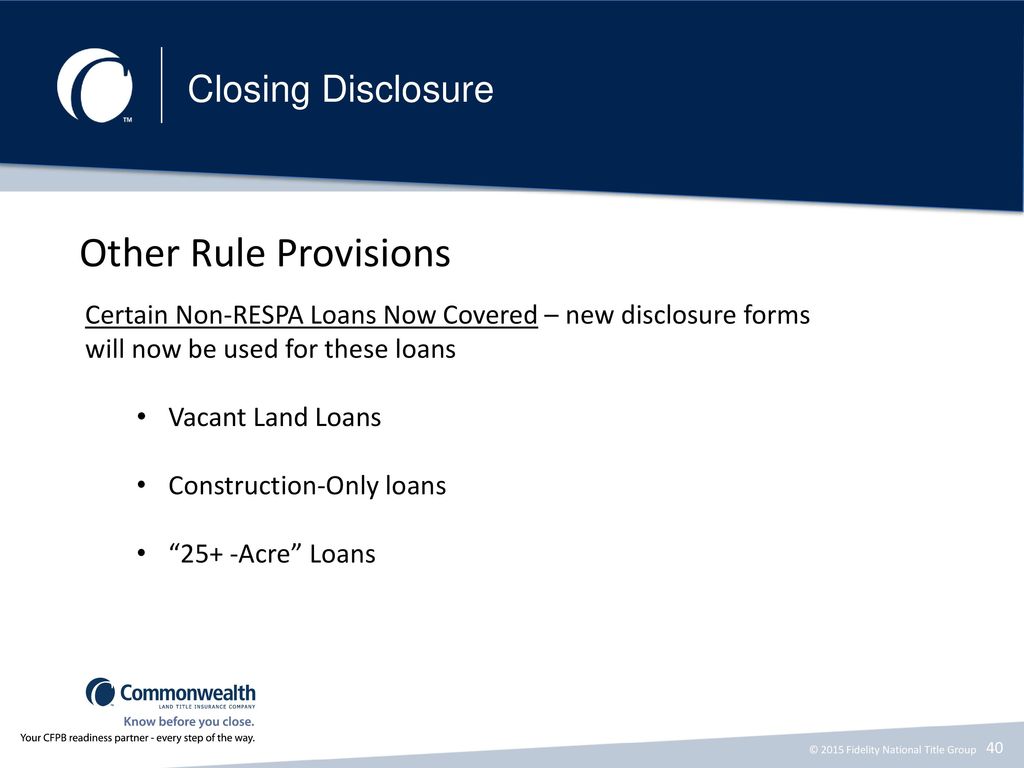

The New Loan Estimate Closing Disclosure Explained Ppt Download

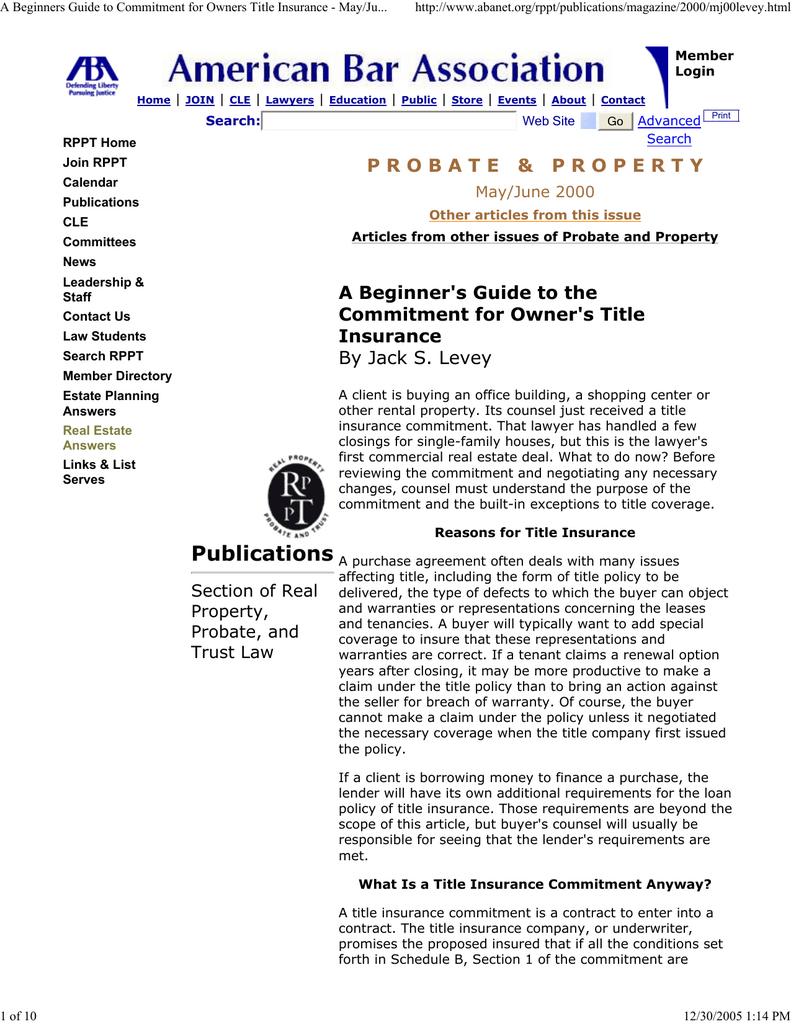

A Beginners Guide To Commitment For Owners Title Insurance

25 Loan Agreement Form Templates Word Pdf Pages

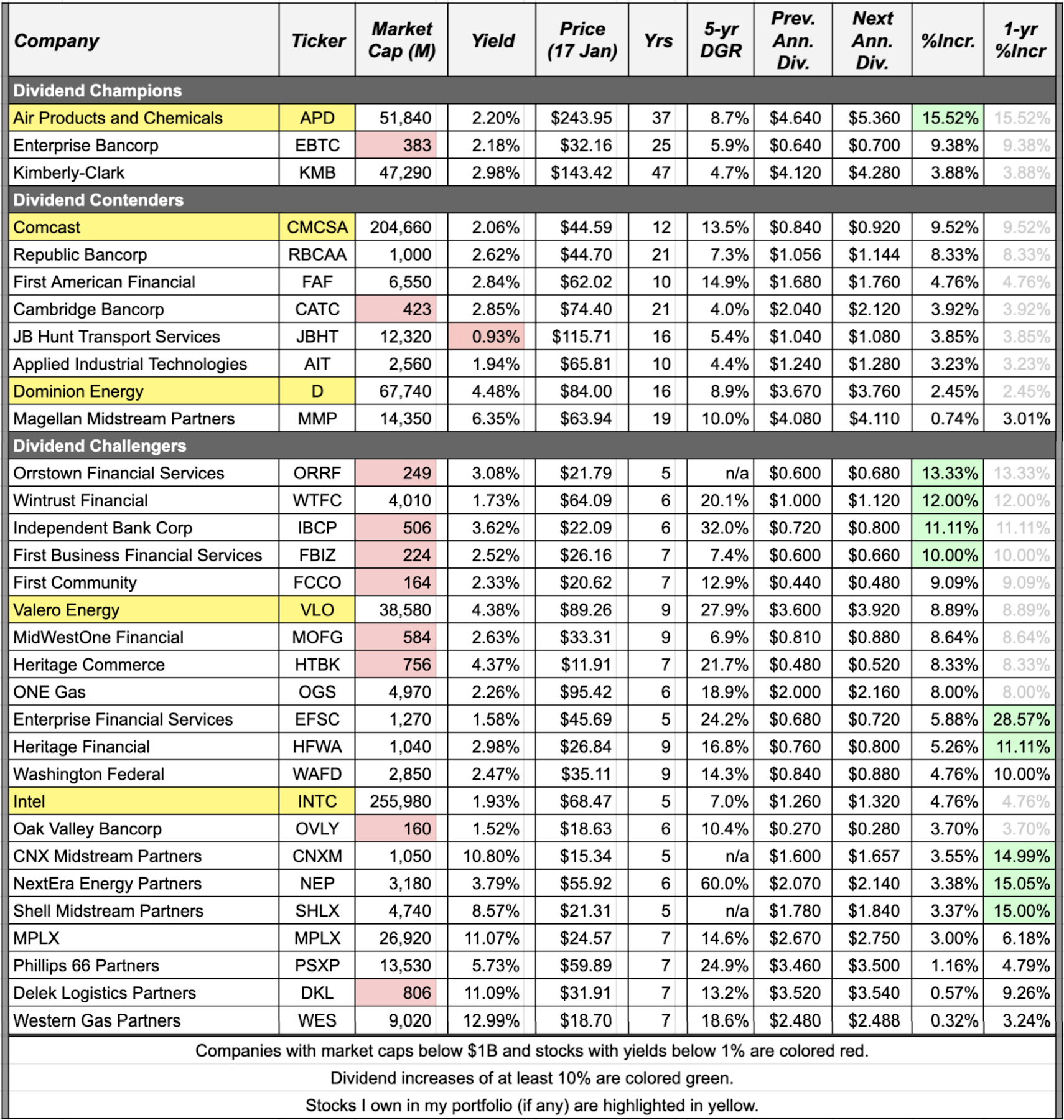

Dividend Increases January 18 24 2020 Seeking Alpha

Title Insurance Owner S Versus Lender S Policy Wharton Law Firm

![]()

Nationwide Home Loans Group Mortgage Loans All 50 States

Owner S Title Insurance What Is It The Truth About Lending

Title Insurance Policy Andrew Robb Re Max Fine Properties

Gmjoph2sujcizm

Title Insurance Get The Actual Advantage