Bond rate of return formula

Contract With 500M Company. To calculate the annual rate of return on a bond divide the bonds interest earned and price appreciation by the bonds value at the beginning of the year.

Current Yield Formula Calculator Examples With Excel Template

Required Rate of Return formula Risk-free rate of return β Market rate of return Risk-free rate of return.

. 0 NPV t 1 T C t 1 I R R t C 0 where. A simple rate of return is calculated by subtracting the initial value of the investment from its current value and then dividing it by the initial value. Rate of return Current value of investment Initial value of investment Initial investment value 100.

Bond Price 100 108 100 108 2. Bond Pricing Formula How. The formula for rate of return is as follows.

Ally Brings Smart Easy Affordable Robotics to a Shrinking Labor Force. If youve held a bond over a long period of time you might want to calculate its annual percent return or the percent return divided by the number of years youve held the. Lets calculate the price of a bond which has a par value of Rs 1000 and coupon payment is 10 and the yield is 8.

30 Lower Production Cost. The maturity of a bond is 5 years. Ad Use Our Simple Tools To Create Your Bond Strategy.

250 20 200 200 x 100 35 Therefore Adam realized a 35 return on his shares over the two-year period. Rate of Return Formula. The expected return on a bond can be expressed with this formula.

Ad See how Invesco QQQ ETF can fit into your portfolio. Where RET e is the expected rate of return F the bonds face or par value and. The formula for annual return is expressed as the value of the investment at the end of the given period divided by its initial value raised to the number of years reciprocal and then minus one.

Plug all the numbers into the rate of return formula. Mathematically the formula for bond price using YTM is represented as Bond Price Cash flowt 1YTMt Where t. The bond yield can be seen as the internal rate of return of the bond investment if the investor holds it until it matures and reinvesting the coupons at.

WACC W d k d 1 t W p s k p s W c e k c e where. Of Years to Maturity. Composite rate fixed rate 2 x semiannual inflation rate fixed rate x semiannual inflation rate 00000 2 x 00481 00000 x 00481 Composite rate.

WACC Weighted average cost of capital firm-wide required rate of return W d Weight of debt k d. Ad Build Your Portfolio Your Way. Choose Investments Using 0 Online Stock and ETF Trades.

On the other hand the term current yield. RET e F-PP. Access the Nasdaqs Largest 100 non-financial companies in a Single Investment.

C t Net cash inflow during the period t C 0 Total initial investment costs I R R The internal rate of return t The number of.

Coupon Bond Formula How To Calculate The Price Of Coupon Bond

Bond Yield Formula Calculator Example With Excel Template

Current Yield Bond Formula And Calculator Excel Template

Bond Pricing Formula How To Calculate Bond Price Examples

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

Coupon Rate Formula Calculator Excel Template

Yield To Maturity Ytm Formula And Calculator

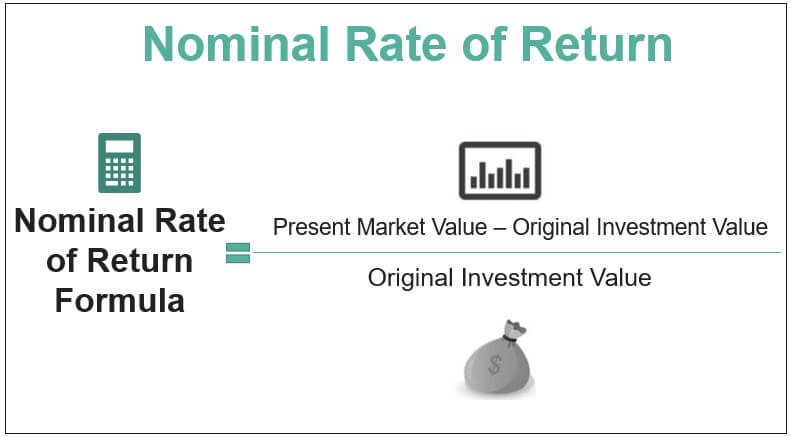

Nominal Rate Of Return Definition Formula Examples Calculations

Bond Yield Formula And Calculator Excel Template

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

Coupon Rate Formula Calculator Excel Template

Bond Yield Calculator

Coupon Rate Formula And Bond Yield Calculator Excel Template

Yield To Maturity Approximate Formula With Calculator

Bond Yield Calculator

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

Yield To Maturity Fixed Income